Within Our Bank

- What are the different types of funds transfer available?

Two types of funds transfer are available to you through our Internet Banking Service: Same Party Account Transfer Pre-registered Third Party Account Transfer

- What are the transaction limits in your Internet Banking Service?

The daily maximum limit of funds transfer, are as follows:

|

Transaction Type

|

Personal Account

|

Business Account

|

Same Party Pre-registered Account Transfer

(Including purchase of Cashier's Order and Demand Draft to be collected by account holder at designated branch) |

Unlimited |

Unlimited |

Pre-registered Third Party Account Transfer

(Including transfer within our bank accounts and transfer to other bank accounts) |

Total daily limit:

HKD500,000 *

Customer can further define the individual transfer limit per Pre-registered account upon application

- For CNY Telegraphic transfer, the maximum total daily limit is CNY80,000 per customer which is only applicable for Personal Account at the moment

- For CNY funds transfer, the maximum total daily limit is CNY20,000 per customer

- RMB accounts for non-Hong Kong residents do not have limitation. Please note that CNY transfer has to meet the regulatory requirements for the beneficiary bank country. If not, it may cause a refund and leads to other charges. |

Total daily limit:

HKD20,000,000 **

Customer can further define the individual transfer Pre-registered account upon application |

Non-registered Third Party Account Transfer

(Including transfer within our bank accounts and transfer to other bank accounts) |

HKD100,000 for Two-Factor Authentication user ****

Zero amount for Non Two-Factor Authentication user |

HKD2,000,000 for Two-Factor

Authentication user ****

Zero amount for Non Two-Factor Authentication user |

General Bill Payment

(Including all bill payments, credit card payments and donations) |

HKD100,000 * |

HKD500,000 * |

| Tax Payment |

HKD500,000 * |

HKD3,000,000 * |

| White Form eIPO Online Payment |

HKD4,000,000 * |

N/A |

Currency Exchange

|

- HK500,000,000 or its equivalent

|

- HKD500,000,000 or its equivalent

|

- Between HKD and AUD, CAD, CHF, EUR, GBP, JPY, NZD

|

- HKD50,000,000 or its equivalent

|

- HKD50,000,000 or its equivalent

|

|

|

- HKD50,000,000 and its equivalent

|

- HKD50,000,000 and its equivalent

|

|

|

- RMB20,000 and its equivalent

|

- Not applicable at the moment

|

* Customer can define the transfer limit upon application, and the customer can also reduce the transfer limit via Internet (the reduction transfer limit function is not applicable for company customer).

** Customer can further define the individual transfer limit per Pre-registered account upon application.

*** The limits are shared between Internet Banking and Mobile Banking.

**** Please note that this limit will be reset to “Zero” if you have not performed a fund transfer to a non-registered 3rd party account via Internet Bankign for 12 months. To reset the related transfer limit, please visit any of our branches.

- What are the service hours for the function of fund transfer?

Please refer to our service hours (links to Account Operation, Question 2)

- Can I preset a scheduled transfer?

Yes, you can make your scheduled transfer 90 calendar days ahead of time and the effective date must be a bank business day.

- Can I delete a scheduled transfer?

Yes, you can delete your scheduled transfer anytime online before the effective date.

- Can I make any amendments to the scheduled transfer?

This is not available at the moment. You can delete your scheduled transfer anytime online before the effective date.

|

To Local/Overseas Bank Account - Electronic Clearing

- Can I transfer funds to other banks in Hong Kong through your Internet Banking Service?

Yes, you can transfer funds to other banks in Hong Kong by CHATS in HK dollar or US dollar through our Internet Banking Service. Besides, you can transfer funds to other banks in Hong Kong by Electronic Clearing in Hong Kong dollar through our Internet Banking Service.

- Do I need to pre-register the beneficiary accounts for fund transfer by Electronic Clearing through your Internet Banking Service?

Yes, you need to register the beneficiary accounts for fund transfer by Electronic Clearing through our Internet Banking Service at branch. If you have registered two-factor authentication as authorization method, you need not to pre-register any beneficiary account for transferring funds to other local banks.

- How many beneficiary accounts can be pre-registered for fund transfer to other banks in Hong Kong through your Internet Banking Service?

There is no limit of pre-registered beneficiary accounts in the Internet Banking for transferring funds.to other banks in Hong Kong (including transfer by CHATS and Electronic Clearing).

- What is the maximum amount that I can transfer by Electronic Clearing? Please refer to the limits table. (links to Account Operations, Question 1)

Please refer to the limits table. (links to Account Operations, Question 1)

- Is there any service charge involved in transfer by Electronic Clearing through your Internet Banking Service?

No, this service is free of charge.

- What are the service hours for the function of Electronic Clearing?

Please refer to our service hours (links to Account Operation, Question 2)

- When will the beneficiary receive the money if I perform an Electronic Clearing Instruction today?

Instruction accepted before cutoff time, funds will be credited to the recipient's account by the end of the day, subject to the recipient bank's arrangement. Otherwise, funds will be credited to the recipient account on the next day, subject to the recipient bank's arrangement. (Cutoff time: Mon - Fri 2p.m. Instruction received after Fri 2p.m. would be executed on the next Mon)

- Can I preset a scheduled Electronic Clearing Instruction?

Yes, you can preset your scheduled Electronic Clearing Instruction 90 calendar days ahead of time and the effective date must be a bank business day.

- Can I delete a scheduled instruction?

Yes, you can delete your scheduled instruction anytime online before the effective date.

- Can I make any amendments to the scheduled Electronic Clearing Instruction?

This is not available at the moment. You can delete your scheduled instruction anytime online before the effective date.

- Do I need to have sufficient fund in my account when I make a scheduled Electronic Clearing Instruction?

Yes, it is necessary to have sufficient fund in your account when you make a scheduled instruction. Moreover, your instruction will be rejected if there is insufficient fund in your account on the effective date of the transfer.

- How do I know the result of my scheduled Electronic Clearing Instruction?

You can check whether the transaction has been accepted or rejected in Transfer/Remittance Instruction Enquiry under Fund Transfer and Remittance on the execution date.

|

To Local/Overseas Bank Account - CHATS

- Can I transfer funds to other banks in Hong Kong through your Internet Banking Service?

Yes, you can transfer funds to other banks in Hong Kong by CHATS in HK dollar or US dollar through our Internet Banking Service. Besides, you can transfer funds to other local banks by Electronic Clearing in Hong Kong dollar through our Internet Banking Service.

- Do I need to pre-register the beneficiary accounts for fund transfer by CHATS through your Internet Banking Service?

Yes, you need to register the beneficiary accounts for fund transfer by CHATS through our Internet Banking Service at branch. If you have registered two-factor authentication as authorization method, you need not to pre-register any beneficiary account for transferring funds to other local banks.

- How many beneficiary accounts can be pre-registered for fund transfer to other banks in Hong Kong through your Internet Banking Service?

There is no limit of pre-registered beneficiary accounts in the Internet Banking for transferring funds to other banks in Hong Kong (including transfer by CHATS and Electronic Clearing).

- What is the maximum amount that I can transfer by CHATS?

Please refer to the limits table. (links to Account Operations, Question 1)

- Is there any service charge involved in transfer by CHATS through your Internet Banking Service?

Yes, charges are levied on your designated payment account by system automatically. Please refer to the “Service Charges Table” for details.

- What are the service hours for the function of CHATS?

Please refer to our service hours (links to Account Operation, Question 2)

- When will the beneficiary receive the money if I perform a CHATS transfer today?

The remittance amount and fees will be debited from your account immediately and the beneficiary will receive the money on the same day.

- Can I preset a scheduled transfer for CHATS?

Yes, you can preset your scheduled transfer through CHATS 90 calendar days ahead of time and the effective date must be a bank business day exclusive of Saturday for USD/EUR transfer.

- Can I delete a scheduled transfer for CHATS?

Yes, you can delete your scheduled transfer for CHATS anytime online before the effective date.

- Can I make any amendments to the scheduled transfer for CHATS?

This is not available at the moment. You can delete your scheduled transfer for CHATS anytime online before the effective date.

- Do I need to have sufficient fund in my account when I make a scheduled transfer for CHATS?

Yes, it is necessary to have sufficient fund in your account when you make a scheduled transfer for CHATS. Moreover, your instruction will be rejected if there is insufficient fund in your account on the effective date of the transfer.

- How do I know the result of my scheduled transfer for CHATS?

You can check whether the transaction has been accepted or rejected in Transfer/Remittance Instruction Enquiry under Fund Transfer and Remittance on the execution date.

|

To Local/Overseas Bank Account - Telegraphic Transfer

- Can I transfer funds overseas through your Internet Banking Service?

Yes, you can transfer funds overseas by Telegraphic Transfer through our Internet Banking Service.

- Can I transfer Renminbi to other bank accounts in Mainland China via your Internet Banking Service?

Yes, you can make the CNY Telegraphic Transfer to other banks' account in Mainland China through our Internet Banking Service; however, this service is only applicable for personal CNY account holders at the moment.

- Do I need to pre-register the beneficiary accounts for fund transfer to other banks overseas?

Yes, you need to register the beneficiary accounts if you want to perform fund transfer to other banks overseas through our Internet Banking service. If you have registered two-factor authentication as authorization method, you need not to pre-register any beneficiary account for transferring funds to other banks overseas.

- Do I need to pre-register the beneficiary accounts for transferring Renminbi to other banking accounts in China?

Yes, you need to pre-register the beneficiary accounts at branch and the beneficiaries' name must be registered in Chinese Telex Code unless the beneficiary has no Chinese name. Meanwhile, the remitter's name must be same as the beneficiary. If you have registered two-factor authentication as authorization method, you need not to pre-register any beneficiary account for transferring funds to other banks in China.

- How many beneficiary accounts can be pre-registered for fund transfer to other banks overseas through your Internet Banking Service?

There is no limit of pre-registered beneficiary accounts in the Internet Banking for transferring funds overseas.

- What is the maximum amount that I can transfer by Telegraphic Transfer?

Please refer to the limits table. (links to Account Operations, Question 1)

- Is there any service charge or corresponding fee involved in Telegraphic Transfer through your Internet Banking Service?

Yes, corresponding fee and charges are levied on your designated payment account by system automatically. Please refer to the “Service Charges Table” for details.

- What are the service hours for the function of Telegraphic Transfer?

You can choose our Post-dated Transaction Notification service. SMS/Email notification will be sent to you once the Posted-dated Transaction has been executed.

The remittance amount, corresponding fees and charges will be debited from your account immediately. However, the time of the beneficiary receives the money will depend on the processing time of the corresponding bank concerned.

- Do I need to open a multi currencies account beforehand?

No, it is not necessary. After you have selected the remitting currency, the exchange rate and the HKD equivalent amount will be provided in the next screen for your confirmation before proceeding.

- Do I need to open a Renminbi account beforehand for performing CNY Telephic Transfer via Personal Internet Banking Services?

Yes, you need to open a CNY Account beforehand. It is because the remittance amount must be debited from the remitter's CNY Account.

- Can I preset a scheduled Telegraphic Transfer?

Yes, you can preset your scheduled Telegraphic Transfer in same currency 90 calendar days ahead of time and the effective date must be a bank business day exclusive of Saturday.

- Can I delete a scheduled Telegraphic Transfer?

Yes, you can delete your scheduled Telegraphic Transfer anytime online before the effective date.

- Can I make any amendments to the scheduled Telegraphic Transfer?

This is not available at the moment. You can delete your scheduled Telegraphic Transfer anytime online before the effective date.

- Do I need to have sufficient fund in my account when I make a scheduled Telegraphic Transfer?

Yes, it is necessary to have sufficient fund in your account when you make a scheduled Telegraphic transfer. Moreover, your instruction will be rejected if there is insufficient fund in your account on the effective date of the transfer.

- How do I know the result of my scheduled Telegraphic Transfer?

You can check whether the transaction has been accepted or rejected in Transfer/Remittance Instruction Enquiry under Fund Transfer and Remittance on the execution date.

|

Remittance

- What is the remittance information of ICBC(Asia)?

1) SWIFT code : UBHKHKHH

2) Bank name(Chinese) : 中國工商銀行(亞洲)有限公司

3) Bank name(English) : Industrial and Commercial Bank of China (Asia) Limited

4) Bank address(Chinese) : 香港中環花園道3號, 中國工商銀行大廈33樓

5) Bank address(English) : 33/F, ICBC Tower, 3 Garden Road, Central, Hong Kong

6) Bank code : 072

7) Bank account : your bank account

- How can I register other bank accounts for fund transfer?

If you would like to register other bank accounts for fund transfer, please visit our branch for processing or please fill in form.

Please send the filled form to our branch for processing. For branch details, please visit here

- What is "ICBC Remittance" Service?

"ICBC Remittance" service is designed according to the usual practice of ICBC customer in mainland China. Apart from remitting funds to ICBC Account in mainland China("ICBC Account"), you can also transfer funds within our bank, to other local and overseas banks.

Below is the function list:

- CNY Remittance to ICBC

- Non-CNY Remittance to ICBC

- Other Overseas Remittance

- Same/Local bank Transfer

- Transfer within our bank and currency trading

- Free Transfer - Electronic Clearing

- Express Transfer - Chats

- Could you provide the service details of the transfer/remittance servcies, including transaction limit, service hour and service charge, etc?

Below is the comparison table of the various transfer/remittance services

| |

CNY Remittance to ICBC |

Non-CNY Remittance to ICBC |

Other Overseas Remittance |

Same/Local bank Transfer |

| Transfer within our bank and currency trading |

Free Transfer - Electronic Clearing |

Express Transfer - Chats |

| Beneficiary Account |

Must be pre-registered ICBC CNY same-name Accounts |

ICBC Accounts |

China or Overseas Accounts |

ICBC(Asia) Accounts |

HK Local Bank Accounts |

| Service Charge |

HKD 100 |

HKD 100 |

HKD 100 - 140 |

Free |

Free |

HKD 100 |

| Remittance CCY |

CNY |

Non-CNY* |

Non-CNY* |

CNY and Non-CNY* |

HKD |

HKD, USD, EUR, CNY |

| Processing Time |

1 Day at the earliest |

Depends on beneficiary banks |

Instant |

3 Days |

Can be same Day |

| Remittance Limit |

CNY80,000 or your preset limit, depends on which is lower |

- Pre-registered account, the daily transaction limit is HKD500,000

- Non-registered account, the daily transaction limit is HKD100,000 and requires two factor authentication

(or your preset limit, depends on which is lower)

|

| Service Hour |

Accept instruction 24 hours

Except instruction submitted within below time period and Public holidays, the bank will process the instruction on next business hours:

Monday 9:00am to 3:00pm (2:00pm for CNY and CAD)

Tuesday to Friday 0:00am to 3:00pm (2:00pm for CNY and CAD) |

Accept instruction 24 hours |

Accept instruction 24 hours |

Accept instruction 24 hours

Except instruction submitted within below time period and Public holidays, the bank will process the instruction on next business day:

Monday to Friday 9:30am to 5:00pm (4:00pm for CNY and EUR) |

| * Non-CNY Currencies include: HKD, AUD, CAD, GBP, EUR, SGD, CHF, NZD, JPY, USD |

- Do I need to pre-register the beneficiary accounts for transferring Renminbi to ICBC bank accounts in China?

Yes, you need to pre-register the beneficiary accounts at branch and the beneficiaries' name must be registered in Chinese Telex Code unless the beneficiary has no Chinese name. Meanwhile, the remitter's name must be same as the beneficiary.

On the other hand, you must have a CNY bank account. Please go to open a CNY account (only applicable for Hong Kong Identity Card Holder)

|

Standing Instruction

- What is the standing instruction service in the Internet Banking about?

The standing instruction in Internet Banking is enhancement for the periodic fund transfer/remittance service. After the standing instructions have been set up, our bank will carry out the fund transfer to your own account in the Internet Banking or the registered third party account according to the frequency and the period you specify.

- How is a standing instruction stopped in the Internet Banking?

A standing instruction in the Internet Banking can be stopped after an expiry day or manually stopped if “until further notice” is chosen.

- How can I enquire the details of a standing instruction through the Internet Banking?

You can enquire an existing standing instruction using the menu item of “My Standing Instruction” in the Internet Banking.

- Can the bank notify me each time when the standing instruction has been carried out?

Yes. You can specify an email address or the Inbox message of the Internet Banking to receive notifications each time when the standing instruction has been carried out. You can also choose to stop receiving the notifications anytime.

- Are there charges when I set up a standing instruction in the Internet Banking?

We have setup service charge when a standing is setup via the Internet Banking. It is now free of setup charge as the Internet Banking Standing Instruction service is undergoing a promotion campaign.

- What frequency can a standing instruction be carried out in?

A standing instruction can be carried out daily, weekly, monthly, or by month end. For standing instructions carried out daily, weekly and monthly, if the payment day falls on a non-banking business day, the standing instruction will be postponed to the following banking business day. For standing instructions ordered on month-end, if the day of the month end falls on a non-banking business day, the standing instruction will be carried out on the last banking business day of that month.

- What is the business day and business hours for the standing instruction service in the Internet banking of your bank?

Our bank will carry out your standing instructions on the business day of the bank. The business day and office hours are as follows:

1. Fund transfer within the bank

(1) fund transfer not involving exchange: all calendar days.

(2) fund transfer involving exchange: Monday 8:00 a.m. to Saturday 1:00 p.m (Except for December 25 and January 1).

2. Electronic clearing

Saturday, Sunday and public holidays: not open for businessMonday to Friday: 24 hours.

3. CHATS

HKD and USD: Monday to Friday: 9:00a.m. - 5:00p.m. (except for Saturday, Sunday and public holidays)

EUR and CNY: Monday to Friday: 9:00a.m. - 4:00p.m. (except for Saturday, Sunday and public holidays)

4. Telegraphic Transfer (T/T):

HKD and USD: Monday to Friday: 9:00a.m. - 5:00p.m. (except for Saturday, Sunday and public holidays)

CNY: Monday to Friday: 9:00a.m. - 2:30p.m. (except for Saturday, Sunday and public holidays)

Other currencies: Monday to Friday: 9:00a.m. - 3:00p.m. (except for Saturday, Sunday and public holidays)

5. ICBC Express:

HKD and USD: Monday to Friday: 9:00a.m. - 5:00p.m. (except for Saturday, Sunday and public holidays)

- Can I setup a standing instruction of remittance in RMB to my account with a bank in Mainland China?

Yes. Please be reminded that the remittance shall be in compliance with all applicable regulations , rules and laws in Mainland China. Otherwise, the receiving bank may return the remittance and additional charges may be incurred. In addition, crediting the ordered amounts to the beneficiary account is subject to the receiving bank's arrangements.

|

Registration for Third-Party Account on Internet Banking

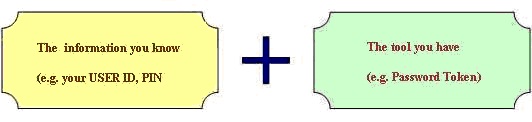

- Do I need a Password Token while registering for a Third-Party Account?

As registering a Third-Party Account is a high-risk transaction, a Password Token will be required. However, a Password Token will not be needed to delete a registered third-party account.

- How can I register for a Third-Party Account?

Customers should fill out a Commercial Internet Banking Service Amendment Form or Commercial Internet Banking Service Supplementary Form. From the authorization setting section, customers can choose “new”, “non-financial transactions” and “register third-party account.” Once approved, customers can complete the registration using Internet Banking, and do not have to visit a branch.

- How can I register for an ICBC (Asia) account?

You can register an ICBC (Asia) account by clicking on the “Fund Transfer and Remittance” tab, then “Register third-party account”, and “Account of ICBC (Asia)”. After filling out the beneficiary account no., part of the A/C Name of Beneficiary will be masked. Fill out the 4 letters that represent the masked information of English name of the at “please enter the English name of the above payee****”. Registration will be completed only after the completion of daily maximum limit for funds transfer, the submission of transaction request and authorization, and by logging out and restarting Internet Banking.

- How long does it take to register for other local bank account, overseas account, and ICBC EXPRESS?

If the accounts are applied and authorized during Mondays to Fridays (except public holidays) from 08:00 to 16:00, the accounts can be activated on the next business day, as opening accounts require information to be processed manually. For hours not specified above, the accounts will be activated in two business days.

|

|