Login Internet Banking

Personal/Private Banking Business Register NowCurrency-Linked Contract

Currency-Linked Contract

Currency-Linked Contract is a contract linked with a currency option that aims to offer you investment income and meet your financial needs for foreign currencies. Depending on the market situation and your financial needs, you may be able to get better returns.

How does a Currency-Linked Contract work?

Simply select one of ten base currency (e.g. HKD, USD, EUR, GBP, CAD, JPY, AUD, NZD, CHF or CNH, etc.) and a linked currency which you may be paid at maturity. You can choose an investment period of 1 week, 2 weeks, 1 month, 2 months, 3 months and 6 months. We will fix an annual interest rate and a strike rate at the time when the deal is made. At maturity, the principal and its earnings will be paid in the Base Currency or Linked Currency whichever has depreciated against the other.

Illustration

| Base Currency |

USD |

| Linked Currency |

AUD |

| Investment Amount |

USD100,000 |

| Trade Date |

11 July |

| Effective Date |

13 July |

| Determination Date |

18 July |

| Maturity Date |

20 July |

| Investment Period |

7 days |

| Interest Rate |

18.37% |

| Strike Rate |

AUD/USD 0.7420 |

On the Determination Date

- if the AUD/USD exchange rate is equal to or higher than 0.7420, you will receive principal and interest in USD at maturity.

- if the AUD/USD exchange rate is lower than 0.7420, you will receive principal and interest in AUD at maturity.

Case for the Currency-Linked Contract

(for an investment period of 1 week with a principal amount of USD100,000)

|

Product Name

|

Interest Rate

2

|

AUD/USD Exchange Rate on the Determination Date

|

P+I at Maturity

|

USD Equivalent at Maturity

3

|

Profit / (Loss)

|

| Currency-Linked Contract |

18.370%p.a.

|

0.7440

|

USD100,357.19

|

USD100,357.19

|

USD357.19

|

|

0.7420

|

USD100,357.19

|

USD100,357.19

|

USD357.19

|

||

|

0.7400

|

AUD135,252.28

|

USD100,086.69

|

USD86.69

|

||

|

0.7380

|

AUD135,252.28

|

USD99,816.18

|

(USD183.82)

|

- Assume the exchange rate of AUD/USD is 0.7420 on the investment date.

- The interest rate are quoted as of 11 July 2005 and are for reference only. They do not represent the actual returns, if any.

- Assume the exchange rate of AUD/USD on the maturity date is the same as that on the determination date.

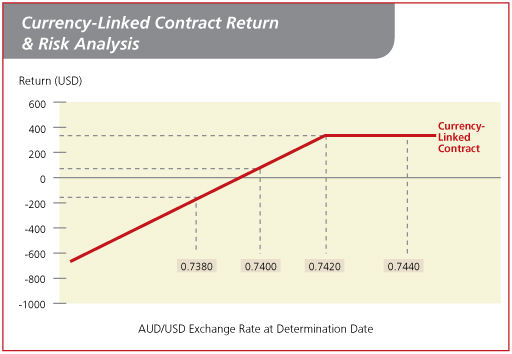

Currency-Linked Contract Return & Risk Analysis

Minimum Investment Amount

The minimum investment amount for Currency-Linked Contract is just USD5,000 (or its equivalent).

Risk Disclosure

- You should not invest in Currency-Linked Contract based on this page alone. Before making any investment decision, you should read the offering documents (including the "Important Facts Statement") to understand the nature and risks of the product.

- This is a structured investment product involving derivatives. The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- Not a time deposit – Currency-Linked Contract is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

- Derivatives risk – Currency-Linked Contract is embedded with foreign exchange option(s). Option transactions involve risks, especially when selling an option. Although the premium received from selling an option is fixed, you may sustain a loss well in excess of such premium amount, and your loss could be substantial.

- Limited potential gain – The maximum potential gain is limited to Interest Amount.

- Maximum potential loss – Currency-Linked Contract is not principal protected: you could lose all your investment amount.

- Not the same as buying the Linked Currency – Investing in Currency-Linked Contract is not the same as buying the Linked Currency directly. Customers cannot enjoy the performance of the Linked Currency.

- Market risk – The return of Currency-Linked Contract is linked to the exchange rates of the Base Currency against the Linked Currency. Movements in exchange rates can be unpredictable, sudden and drastic, and affected by complex political and economic factors.

- Liquidity risk – Currency-Linked Contract is designed to be held till maturity. You do not have a right to request early termination of this product before maturity.

- Credit risk of the Bank – Currency-Linked Contract is not secured by any collateral. When you invest in this product, you will be relying on the Bank’s creditworthiness. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your Principal Amount.

- Currency risk – If the Base Currency and/or Linked Currency is not in your home currency, and you choose to convert it back to your home currency upon maturity, you may make a gain or loss due to exchange rate fluctuations.

- Risks of early termination by the Bank – the Bank has the right (but not the obligation) to terminate this product early upon occurrence of certain events. If this product is terminated by the Bank early, such adjustments or early termination events may negatively affect your return or loss under this product.

- Renminbi Currency risk –If you choose CNY as a Base Currency or a Linked Currency, then you should note the following:

- The Chinese Renminbi is currently a restricted currency. Due to exchange controls and/or restrictions imposed on the convertibility or utilization of CNY which in turn is affected by, amongst other things, the PRC government’s control, there is no guarantee that disruption in the transferability, convertibility or liquidity of CNY will not occur. There is thus a likelihood that you may not be able to convert the Chinese Renminbi received into other freely convertible currencies.

- You should understand the product will be settled in CNY deliverable in Hong Kong, which is different from that of CNY deliverable in Mainland China. As the offshore deliverable Chinese Renminbi market is currently in the developing phase, there is no market standard determination of the exchange rate involving deliverable Renminbi. Customer must therefore be comfortable with the Bank’s good faith determination of the Fixing Rate. All determinations made by the Bank in good faith shall be conclusive and binding on you.

- If you do not have a CNY deposit account outside the People’s Republic of China (which shall exclude the Hong Kong and Macao Special Administrative Regions and Taiwan), you shall be required to open such account with the Bank, in order to receive payment in CNY.

- Should you decide to convert the Renminbi amount back into his/her home currency or vice versa, you should bear in mind the risk of exchange rate fluctuations that may cause a loss on conversion of Renminbi back into such other currency or vice versa.

- The Relevant Strike Rate, Fixing Rate and other relevant exchange rate of the relevant currency pair will be quoted in offshore Renminbi (CNH) against alternate currency.

Important Information

The above risk disclosure statements cannot disclose all the risks involved. Before making investment decision, you should thoroughly study the offering documents, financial reports and relevant risk disclosure statements issued by the issuer of the investment product(s). Further you should consider your own circumstances including financial position, investment experience and objective to ensure the investment is suitable for your particular investment needs and risk tolerance capacity. You should seek independent financial and professional advice before trading or investment. This promotional material does not constitute an offer or solicitation for the purchase or sales of any investment products. This promotional material is issued by Industrial and Commercial Bank of China (Asia) Limited (the “Bank”) and the contents have not been reviewed by Securities and Futures Commission.